kansas sales tax exemption certificate

Kansas Sales Tax Exemption Certificate information registration support. Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms.

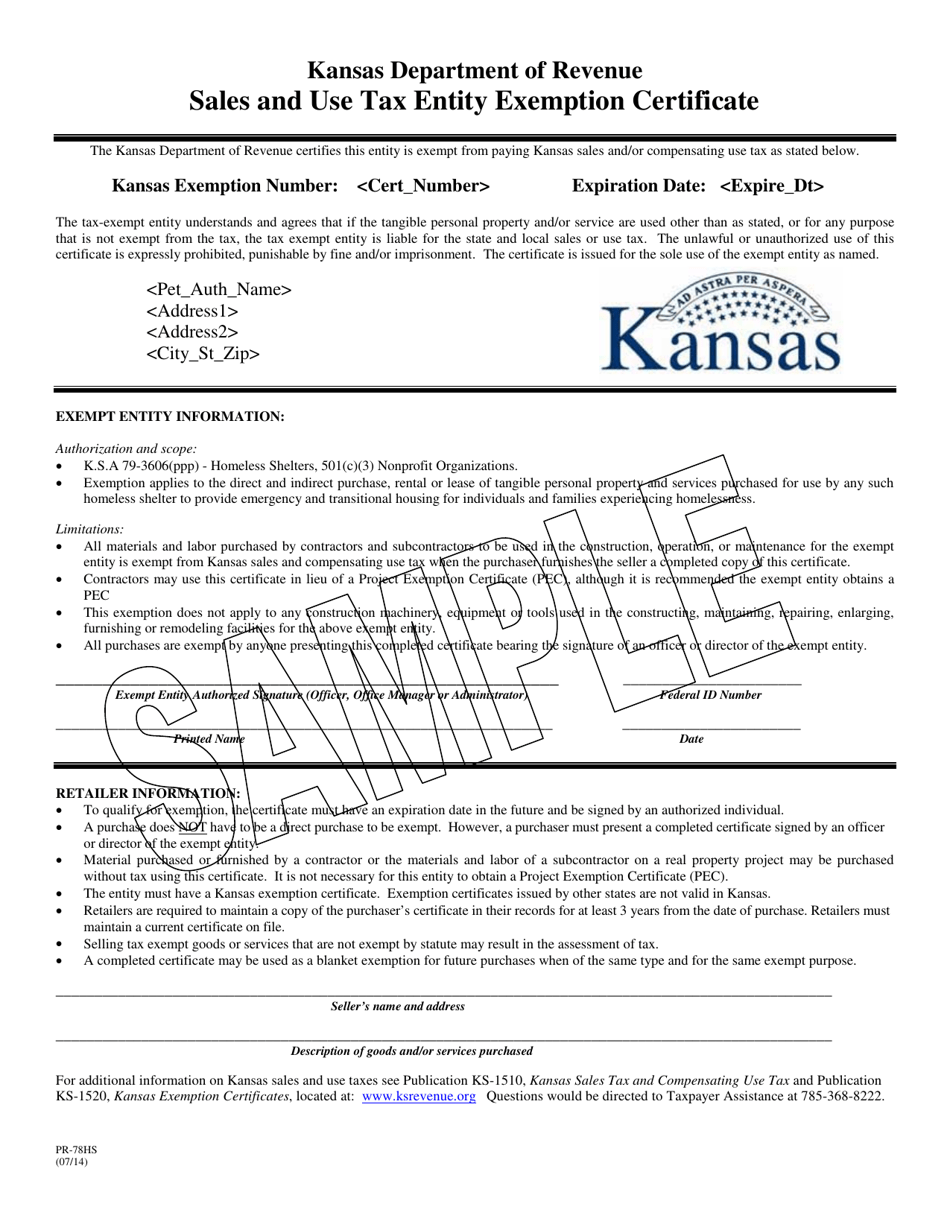

Form Pr 78hs Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Homeless Shelters Sample Kansas Templateroller

Of are exempt from the sales tax local sales tax or compensating City State tax pursuant to KSA.

. If you are accessing our site for the first time. Your Kansas Tax Registration Number 000-0000000000-00. Drop shipped to a Kansas location the out-of-state retailer must provide to the third party vendor a Kansas sales tax registration number either on this certificate or the Multi-Jurisdiction.

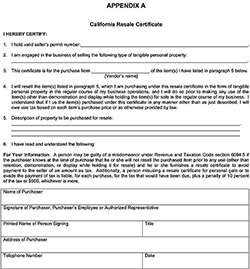

Ad New State Sales Tax Registration. Therefore you can complete the resale exemption certificate form by providing your Kansas Sales Tax Registration Number. Kansas Sales Use Tax for the Agricultural Industry at.

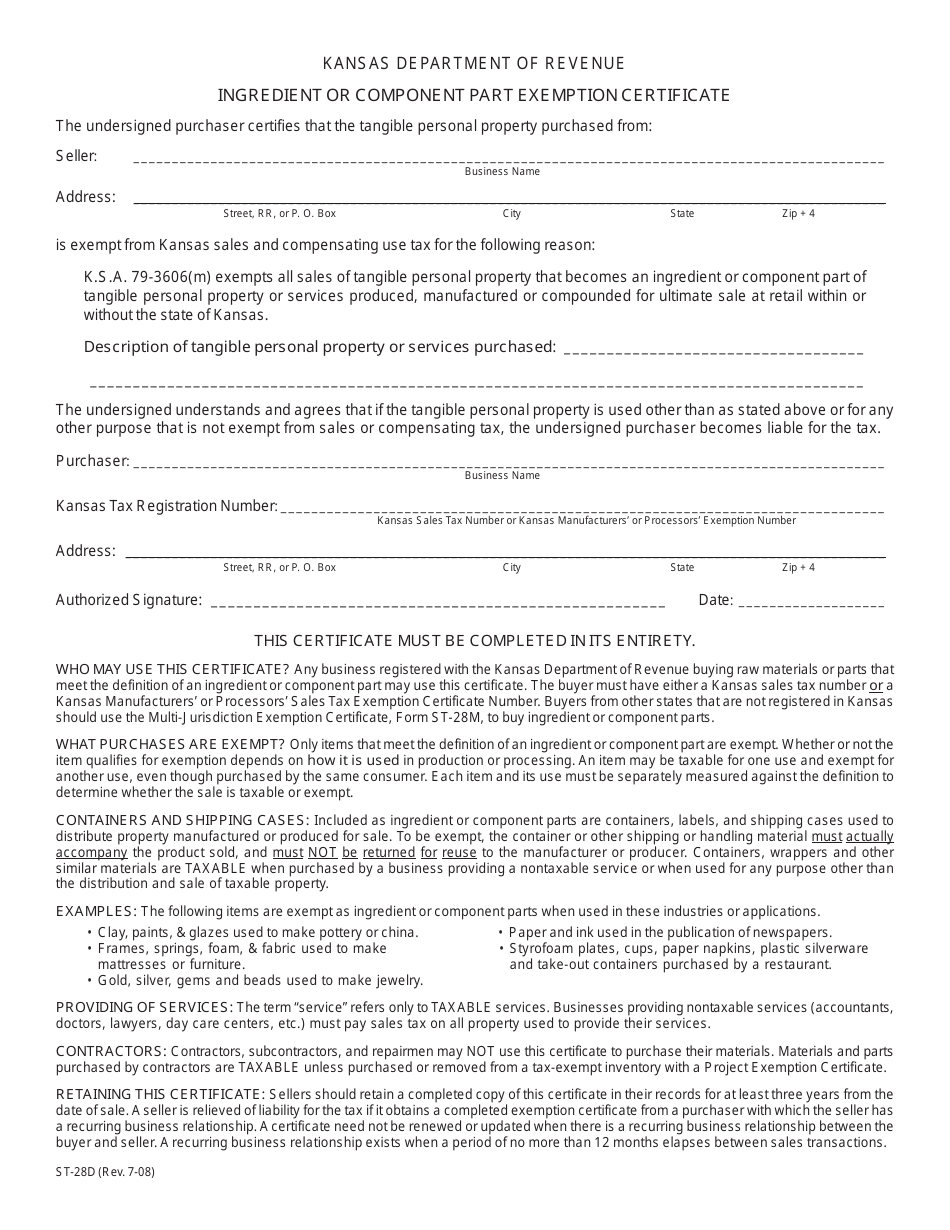

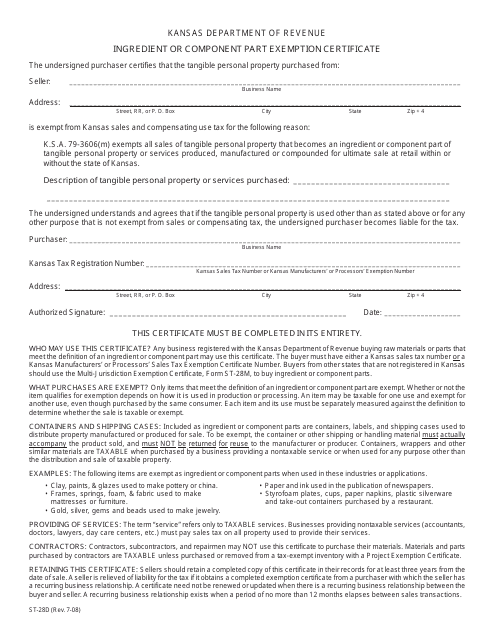

1115 This booklet is designed to help businesses properly use Kansas sales and use tax exemption certificates as buyers and as sellers. Submit Request Begin the process of requesting a new tax clearance View Status View the status of a previously submitted request for tax clearance Verify Certificate Verify the. Ad Vertex is a Leading Provider of Sales Use Tax Solutions for the Public Sector.

Explain why the sale is exempt. Step 1 Begin by downloading the Kansas Resale Exemption Certificate Form ST-28A. 1 Exemption Certificates Pub KS-1520 Rev.

1320 Research Park Drive Manhattan Kansas 66502 785 564-6700 The information contained in this handbook is for informational purposes only and is to be used as a resource. For non-profits that have received a sales tax exemption certificate from the Kansas Department of Revenue the exemption certificate is good only from its effective date. The certificate on file with other sales tax records.

Complete a Kansas Business Tax Application. This page discusses various sales tax exemptions in Kansas. A Single Source Of Truth For Use Tax.

Step 2 Identify the sellers name business address Sales Tax Registration Number and a general. Your Kansas sales tax account number has three distinct parts. It explains the exemptions currently authorized by Kansas.

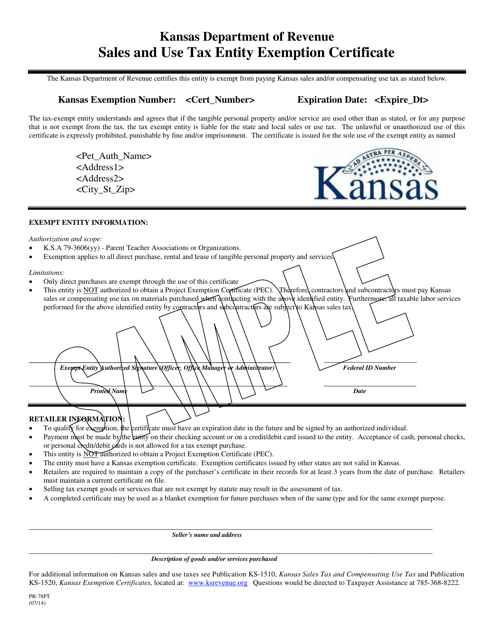

Customizable To Meet Your Business Needs. Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates.

Ad Vertex is a Leading Provider of Sales Use Tax Solutions for the Public Sector. While the Kansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation. Sales Tax Account Number Format.

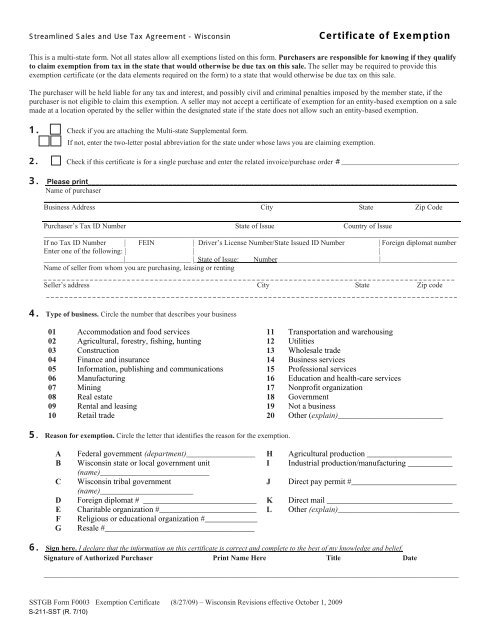

ST-28 Designated or Generic Exemption Certificate Rev. Sales and use tax. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. Customizable To Meet Your Business Needs.

Kansas Application for Sales Tax Exemption Certificates KS-1528 Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and. This publication has been developed to address the Kansas retailers sales. 79-3606 cc and amendments thereto if an HPIP certified business or KSA.

Order for the sale to be exempt. A seller is relieved of liability for the tax if it obtains a completed exemption certificate from a purchaser with which the. How to use sales tax exemption certificates in Kansas.

Enter the Confirmation Number provided on the Certificate of Tax Clearance C000-0000-0000. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. A Single Source Of Truth For Use Tax.

This ia a Contractor Sales Tax Certificate which is a special type of certificate intended for use by contractors who are purchasing goods or tools that will be used in a project contracted by a. Kansas law KSA 40-252d provides for a tax credit for insurance companies equal to 15 percent of Kansas-based employees salaries or up to a maximum of 1125 percent of taxable premiums. An exemption certificate must be completed in its entirety and by regulation KAR.

This booklet is designed to help businesses properly use Kansas sales and use tax exemption certificates as buyers and as sellers. Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts.

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Editable Ordination Certificate Template Beautiful Deacon Ordination In Ordination Certificate Tem Certificate Templates Birth Certificate Template Certificate

Form S 211 Sst Wisconsin Department Of Revenue

Review The Requirements And Process For Obtaining An Employer Identification Number For Tax Employer Identification Number Employment Internal Revenue Service

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow